The 2025 Self-Employed Hair Stylist’s Expense Information: Navigating the Prices of Success

Associated Articles: The 2025 Self-Employed Hair Stylist’s Expense Information: Navigating the Prices of Success

Introduction

With nice pleasure, we’ll discover the intriguing subject associated to The 2025 Self-Employed Hair Stylist’s Expense Information: Navigating the Prices of Success. Let’s weave attention-grabbing data and provide recent views to the readers.

Desk of Content material

The 2025 Self-Employed Hair Stylist’s Expense Information: Navigating the Prices of Success

The lifetime of a self-employed hair stylist is undeniably rewarding, providing artistic freedom and the potential for important earnings. Nevertheless, success hinges on cautious monetary administration. Ignoring bills can shortly erode income, leaving you struggling as a substitute of thriving. This complete information explores the important thing bills a self-employed hair stylist in 2025 ought to anticipate, providing methods for minimizing prices and maximizing profitability.

I. Enterprise Premises & Operational Prices:

The situation of your online business considerably impacts your bills. Choices vary from renting a chair in a longtime salon to leasing a personal studio and even working from your property.

-

Hire/Lease: That is arguably your largest recurring expense. Renting a chair in a shared salon is usually essentially the most reasonably priced choice, however you will share shoppers and doubtlessly utilities. A personal studio provides larger management and branding alternatives however comes with increased lease and utility prices. Dwelling-based companies could have decrease lease (or none), however take into account zoning rules and the potential influence on house insurance coverage. Consider any leasehold enhancements you would possibly must make the house appropriate for your online business. Count on lease will increase in 2025, significantly in fascinating areas.

-

Utilities: Electrical energy, water, heating, and web are important. A personal studio or home-based enterprise will bear the complete price, whereas shared salons could have these prices partially coated or included in lease. Take into account energy-efficient tools to mitigate these bills.

-

Insurance coverage: Skilled legal responsibility insurance coverage (also called errors and omissions insurance coverage) is essential to guard you towards claims of negligence or malpractice. Public legal responsibility insurance coverage protects your online business from claims associated to accidents in your premises. Take into account additionally product legal responsibility insurance coverage should you promote retail merchandise. Store round for aggressive charges, as costs can fluctuate considerably.

-

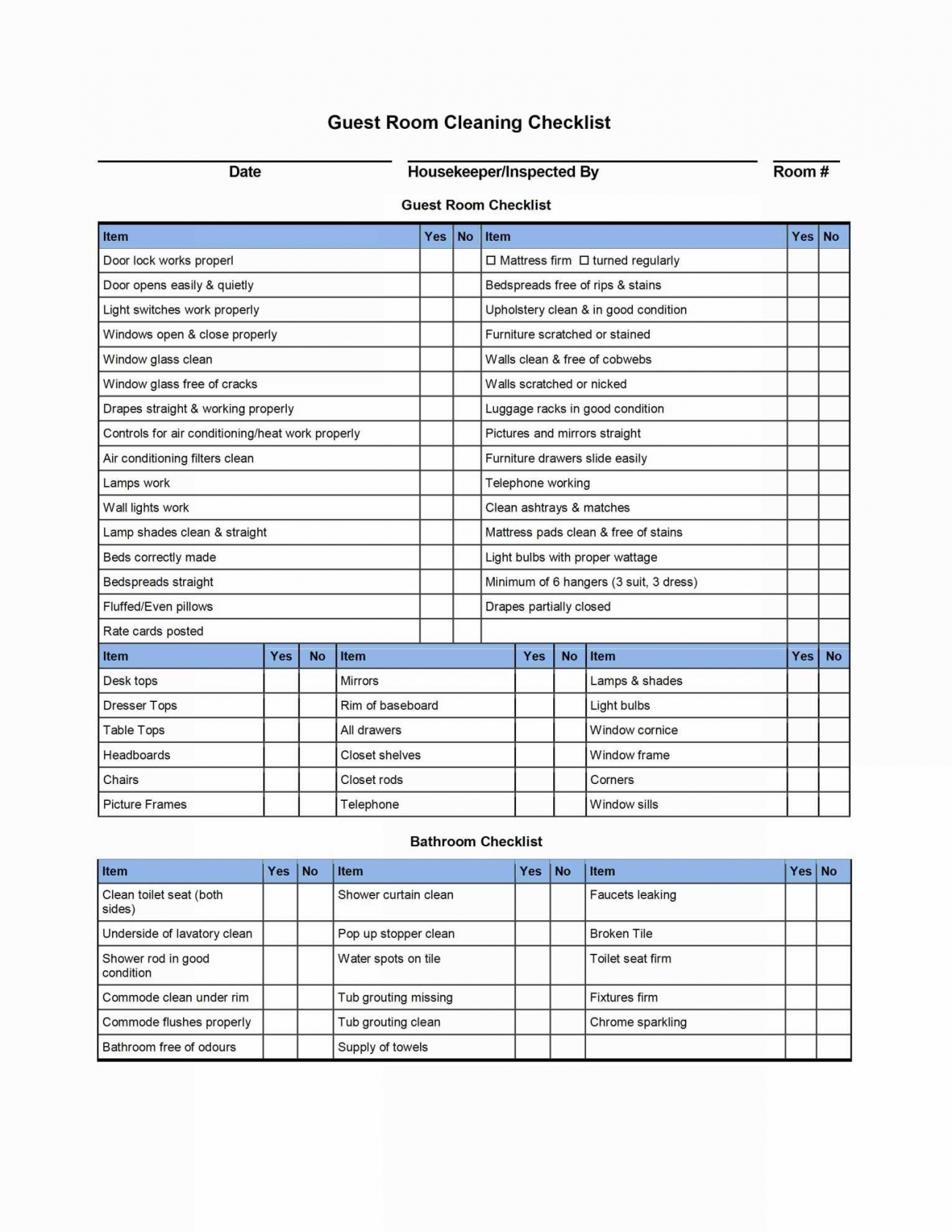

Cleansing & Upkeep: Retaining your workspace clear and hygienic is paramount. This consists of common cleansing provides, waste disposal, and potential upkeep prices for tools or the premises itself. Consider skilled cleansing companies if obligatory.

II. Skilled Provides & Tools:

Sustaining a excessive normal of labor requires investing in high quality merchandise and tools.

-

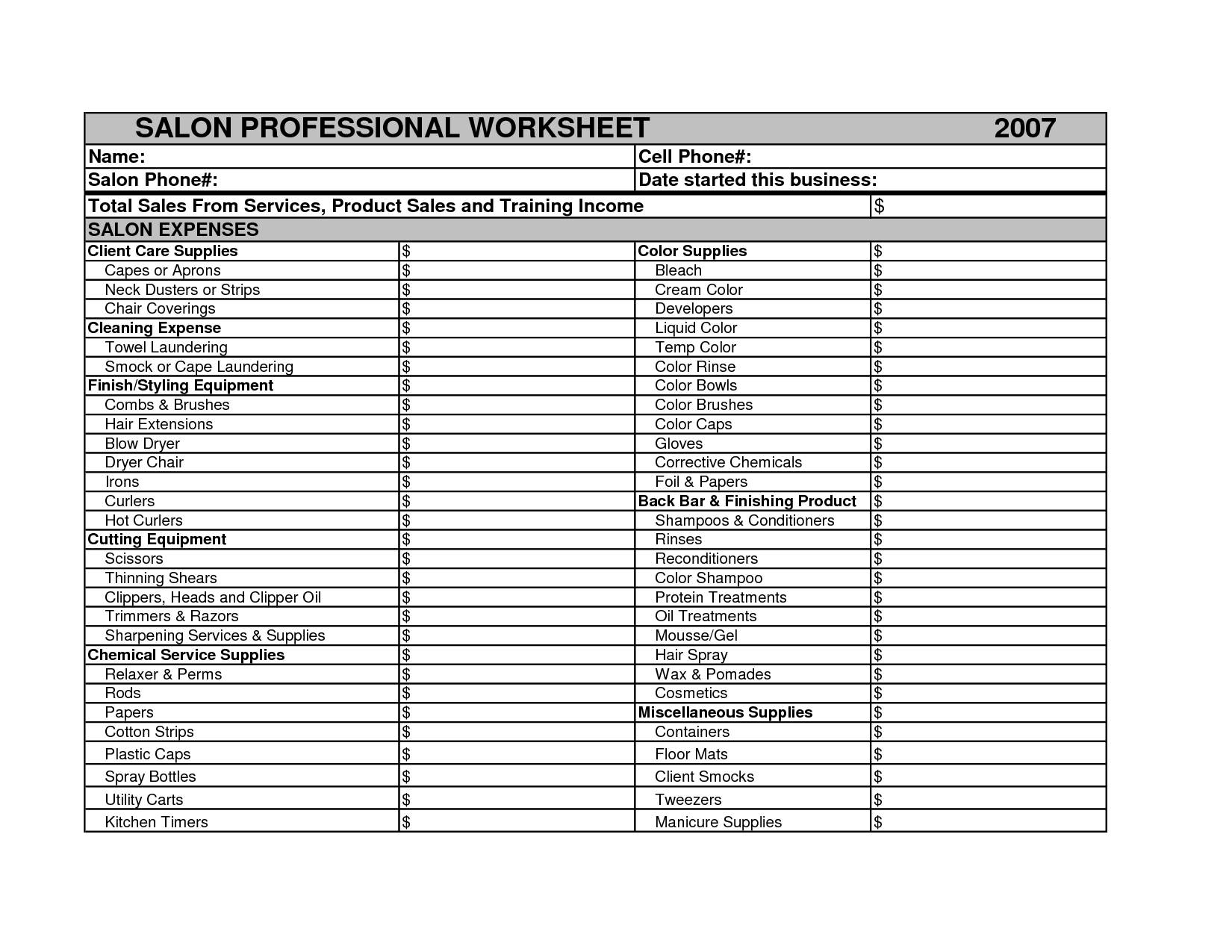

Hair Merchandise: It is a important ongoing expense. Select merchandise that stability high quality with cost-effectiveness. Discover wholesale choices to safe higher pricing. Take into account the altering tendencies in 2025; eco-friendly and sustainable merchandise are gaining recognition.

-

Instruments & Tools: Shears, combs, dryers, curling irons, straighteners, and different styling instruments are important. Investing in high-quality, sturdy tools can get monetary savings in the long term, however issue within the preliminary price. Common upkeep and potential replacements needs to be budgeted for.

-

Coloration Provides: In case you provide coloring companies, this can be a main expense. The price of hair colour, bleach, builders, and toners can add up shortly. Cautious stock administration and minimizing waste are essential. Discover completely different manufacturers and value factors to discover a stability between high quality and affordability.

-

Disposables: Gloves, capes, towels, and different disposable objects are important for hygiene and shopper consolation. Bulk buying can typically scale back prices.

-

Software program & Expertise: Appointment scheduling software program, shopper administration programs, and point-of-sale (POS) programs can streamline your online business operations. Take into account cloud-based choices to attenuate upfront funding. Investing in skilled pictures and video tools for social media advertising and marketing can be vital in 2025.

III. Advertising & Promoting:

Constructing and sustaining a shopper base requires efficient advertising and marketing.

-

On-line Advertising: Knowledgeable web site and lively social media presence are important in 2025. Take into account paid promoting on platforms like Instagram and Fb to succeed in a wider viewers. web optimization optimization is essential for natural search outcomes. The price of skilled web site design and social media administration could be important.

-

Offline Advertising: Native promoting, flyers, enterprise playing cards, and collaborations with different companies can complement your on-line efforts. The price of printing supplies and distributing them needs to be factored into your finances.

-

Consumer Retention Methods: Loyalty packages, referral incentives, and wonderful customer support are essential for retaining shoppers and constructing a powerful status. Whereas these aren’t direct bills, they’re investments that contribute to long-term profitability.

IV. Private & Enterprise Bills:

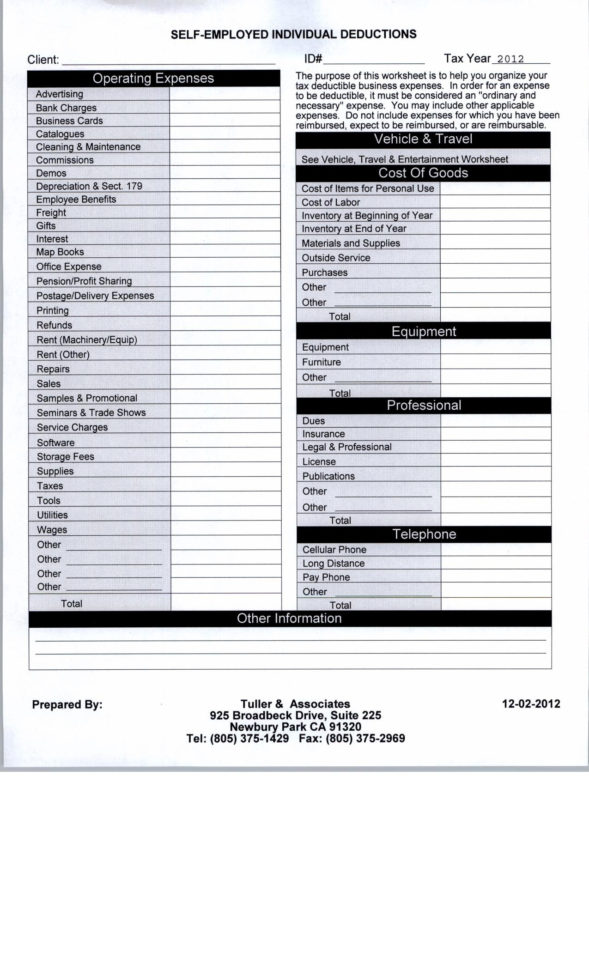

Many bills blur the traces between private and enterprise. Correct record-keeping is essential for tax functions.

-

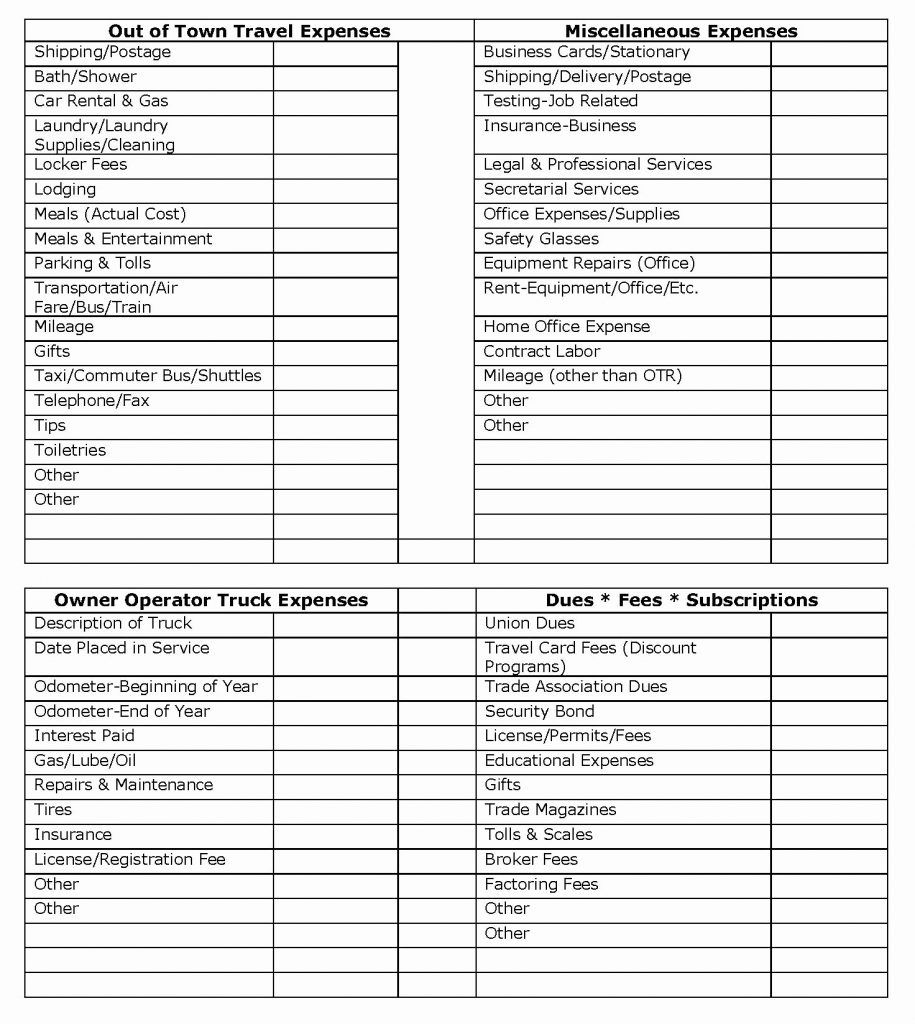

Persevering with Schooling: Staying up to date on the most recent tendencies and methods is essential within the ever-evolving hair business. Put money into workshops, seminars, and on-line programs to boost your abilities. These bills are sometimes tax-deductible.

-

Journey Bills: In case you journey to shoppers’ houses or attend business occasions, these bills are deductible. Maintain meticulous data of mileage, tolls, and lodging prices.

-

Skilled Growth: Membership in skilled organizations can present entry to sources, networking alternatives, and insurance coverage advantages.

-

Accounting & Tax Preparation: Correct bookkeeping and tax preparation are important for complying with rules and maximizing tax deductions. Think about using accounting software program or hiring knowledgeable accountant.

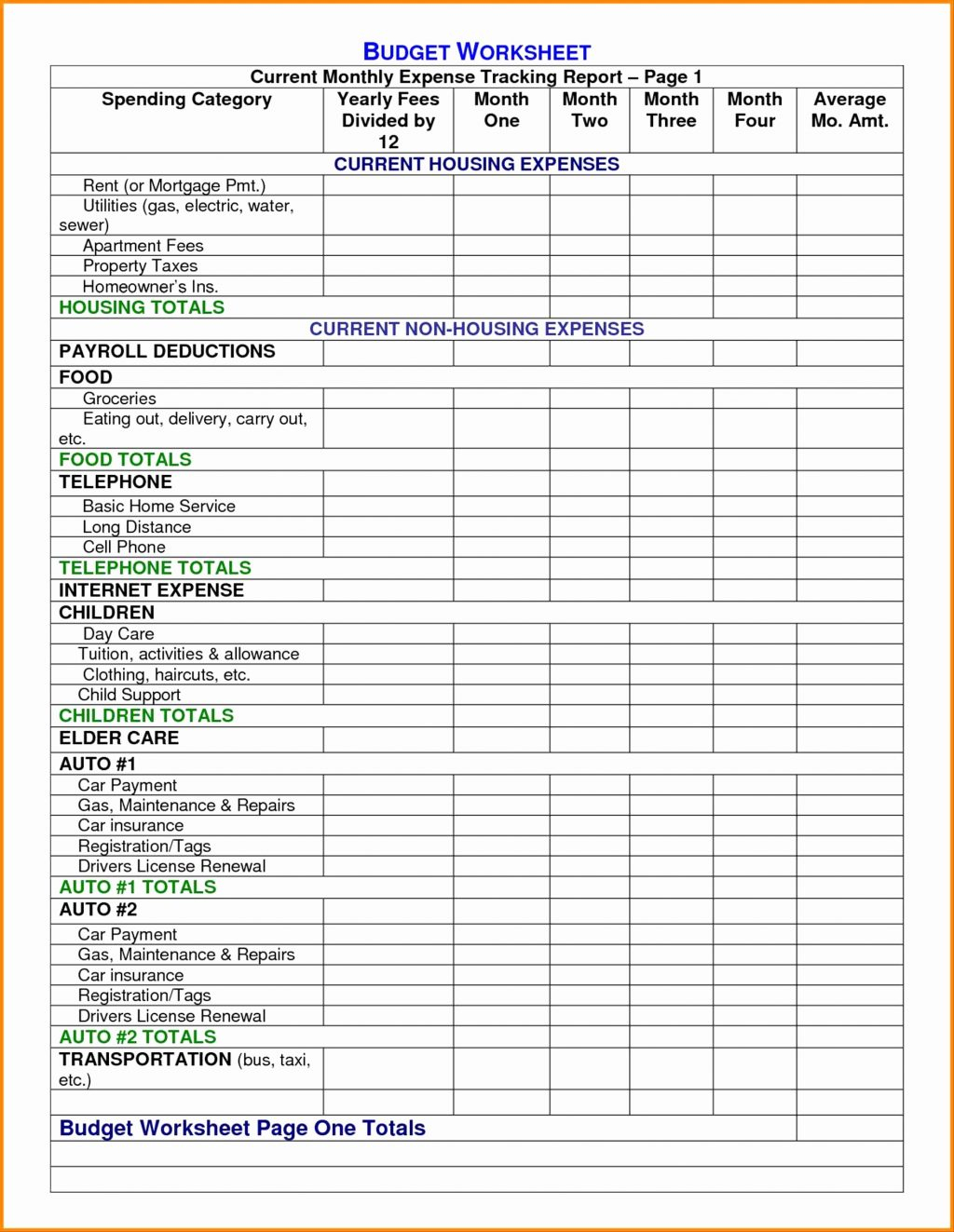

V. Monetary Planning & Budgeting:

Efficient monetary planning is essential for the long-term success of your online business.

-

Create a Enterprise Plan: An in depth marketing strategy outlines your targets, methods, and monetary projections. That is important for securing funding if wanted and monitoring your progress.

-

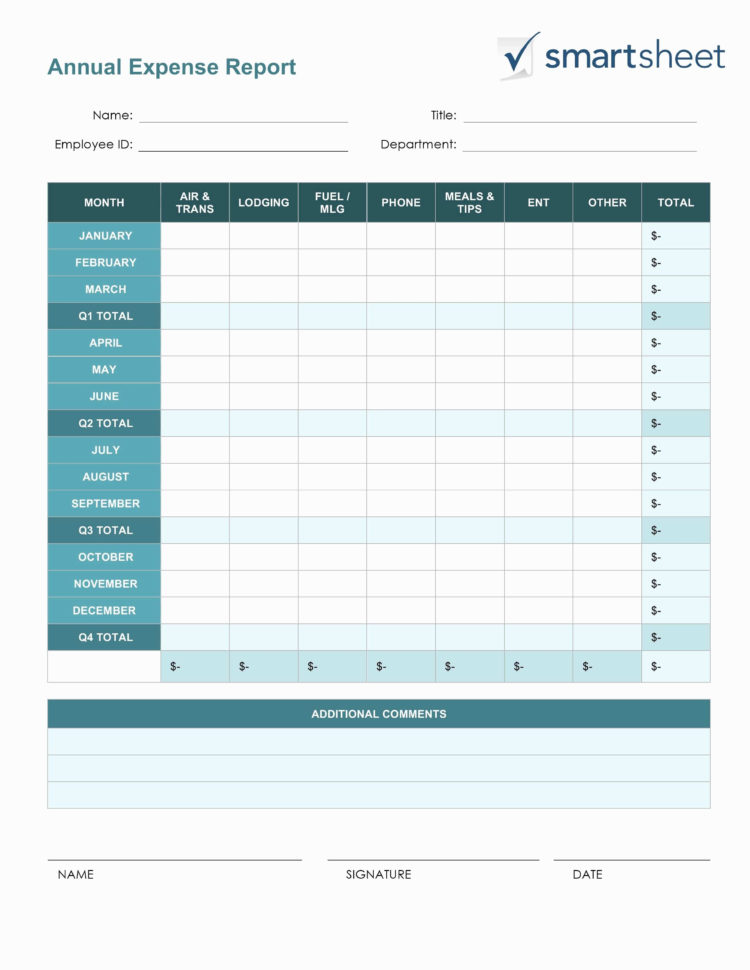

Monitor Revenue & Bills: Use accounting software program or spreadsheets to meticulously observe your earnings and bills. This may aid you determine areas the place you possibly can minimize prices and enhance profitability.

-

Set Life like Costs: Analysis your native market to find out aggressive pricing to your companies. Consider all of your bills to make sure you’re making a revenue. Common value changes could also be essential to mirror rising prices.

-

Emergency Fund: Put aside a portion of your earnings for sudden bills, corresponding to tools repairs or intervals of low earnings.

-

Retirement Planning: As a self-employed particular person, you are accountable for your individual retirement financial savings. Discover choices like SEP IRAs or solo 401(okay) plans.

VI. Tax Implications for Self-Employed Stylists in 2025:

Understanding your tax obligations is paramount. Self-employment taxes (Social Safety and Medicare) are considerably increased than these paid by workers. Seek the advice of with a tax skilled to know your tasks and maximize deductions. Maintain detailed data of all earnings and bills to simplify tax preparation. Concentrate on any modifications in tax legal guidelines in 2025 that will influence your online business.

In conclusion, the bills related to operating a profitable self-employed hair styling enterprise in 2025 are multifaceted. Cautious planning, meticulous record-keeping, and a proactive strategy to price administration are essential for maximizing profitability and guaranteeing the long-term viability of your enterprise. Frequently reviewing your bills and adapting your methods as wanted will mean you can navigate the monetary panorama successfully and give attention to what actually issues: creating lovely hair and constructing a thriving enterprise.

Closure

Thus, we hope this text has offered worthwhile insights into The 2025 Self-Employed Hair Stylist’s Expense Information: Navigating the Prices of Success. We hope you discover this text informative and helpful. See you in our subsequent article!